Book Review: A Richer You - How to Make the Most of Your Money

30 May, 2021

I’ll cut to the chase for those looking for a five-second read: I loved it.

See below to enter the GIVEAWAY and go into the draw to win one of two copies!

Now for the longer version...

In my mind, when I’m thinking about Mary Holm, I always think of her as Aunty Mary. Mary, if you are reading this, that’s meant as a compliment. I tend to wish I had an Aunt Mary when I was growing up, someone to speak wise words into my life. I do have one aunt, but I’ve only met her a couple of times and the most useful thing I learned from her was how to crumb and deep fry camembert cheese. While it was delicious, Aunty Sue went on to have a massive heart attack shortly after this one and only cooking lesson, so safe to say, it’s not a recipe I use all that often. However, I guess what my own aunt inadvertently taught me was to do the opposite of what she does, so today I eat healthily and exercise daily! Cheers Aunty!

Aunty Mary on the other hand has been a constant source of practical wisdom for those in the upper North Island via her Weekend Herald newspaper personal finance Q&A column for many a long year and occasionally I dip into it as she also publishes her column on her own website: NZ Herald Q&A Column

So good is her wisdom that she received the New Zealand Order of Merit (ONZM) for “services to financial literacy education” in 2020. Mary is not a financial advisor, but she is super well qualified to write this column, you can read about her qualifications in her bio from her website: Something About Mary

The last book she wrote, called Rich Enough, while it was good, it did make me a little sleepy in places if I’m being completely honest…

However, this book did not!

And I gave it a pretty solid test for “boringness”:

I read it at 5.30am, but I remained wide awake!

I read it on a quiet weekday, in the early afternoon, while lying on the couch propped up with pillows and with the sun streaming in - a perfect set up for an afternoon snooze - but I once again remained fully alert and awake!! It was a real page-turner.

She has taken the best letters from her newspaper column and worked them into a book with distinct sections:

Part 1: The basics - starting out on the right foot

Part 2: Investments - where to save

Part 3: How best to invest - strategies

Part 4: Retirement - making those hard-earned savings work for you

Part 5: People Stuff - it’s not all about maximizing money

It’s very current too with many of the letters having been written before, during and well after COVID-19 kicked off.

In each letter, the writer asks a short question about an issue they are having that involves personal finances. Mary then gives a concise and well-rounded reply. This makes it a book you can pick up and put down, just taking in a bit at a time. For me, I read it over a couple of days from start to finish and my biggest gripe with personal finance books is usually that they are far too long and could be written in about one-tenth of the pages BUT I found almost all of this book useful from start to finish.

I only wavered in the sections that were less relevant to me, like the retirement section, but that’s only natural right because I’m not there just yet?

And it’s obviously very Auckland focussed as well, given that’s where it’s published and for the rest of Aoteroa that can get pretty tiresome, but there is enough general information that is not location dependent in there to keep me interested. It’s like hearing a private conversation between two people that trust each other and you and I get to listen in on the exchange.

You could have knocked me over…

Another thing that I like about this book is that she links to a lot of useful NZ resources that I can go and check out and it’s good to keep referring people to trusted sites where they can go for information. And you could have knocked me over when I read a question that referenced my own blog The Happy Saver as being useful! Mary could have easily edited this out, but the fact that she left it in made my day, after all, I’m just trying to help people too and because this book reads a lot like my own inbox it made it even more relatable.

A mention of The Happy Saver from page 10-11 of the book.

Direct answers…

When someone asks her directly about a company share or an investment provider she actually answers directly too, instead of sitting on the fence offering vague advice. Instead of the usual “go and seek advice” line that gets trotted out she addresses it more directly than that which I was really grateful for. In my experience people often just want to be told what to do and I know it’s hard to do that when all you have to go on is a quick letter, but sometimes (all of the time) she is not dooming them to a fate of financial disaster by saying it straight. This book is full of real-life money problems that people are having and Mary Holm does the best she can to provide the solution.

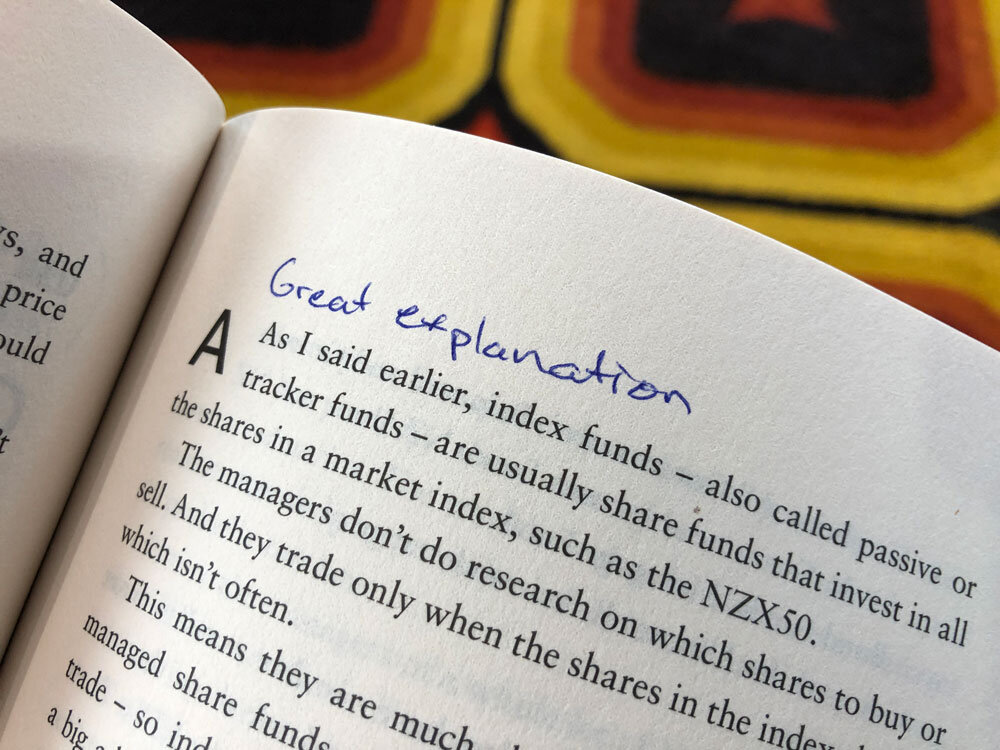

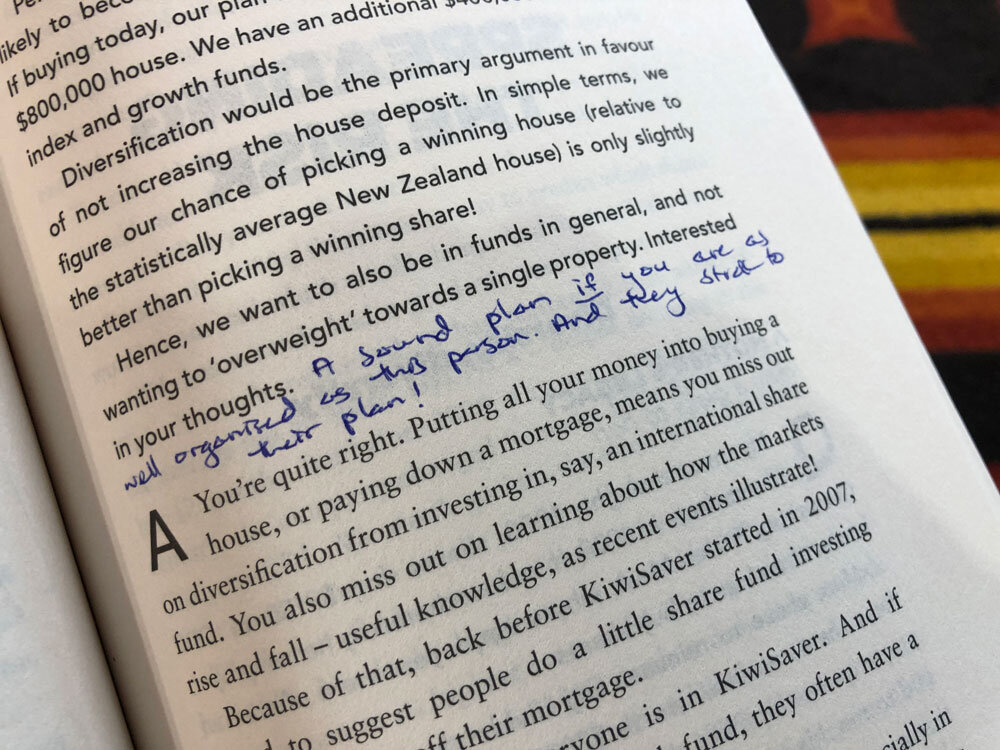

Property features heavily, mainly because, well, for many Kiwis, property features heavily, but she thoroughly talks about other investment options as well, particularly about why index investing will beat a stock picker over time and why the more important thing is diversification when it comes to investing.

An older audience

It’s definitely got an older audience vibe about it, she certainly has a lot of emails sent in from older richer people - mainly because millennials tend not to write to a newspaper column I suspect - but far from being a turn-off, the fact that I would quite like to be an ‘older richer person’ myself one day means that I can take their questions and her answers on board and call it ‘free education’ and take from it what I will. I always enjoy learning from people who have gone before me as I figure ‘why reinvent the wheel’?

It’s like a conversation

This book offers the kind of information I’m drawn to: Good advice. Common sense. Logical.

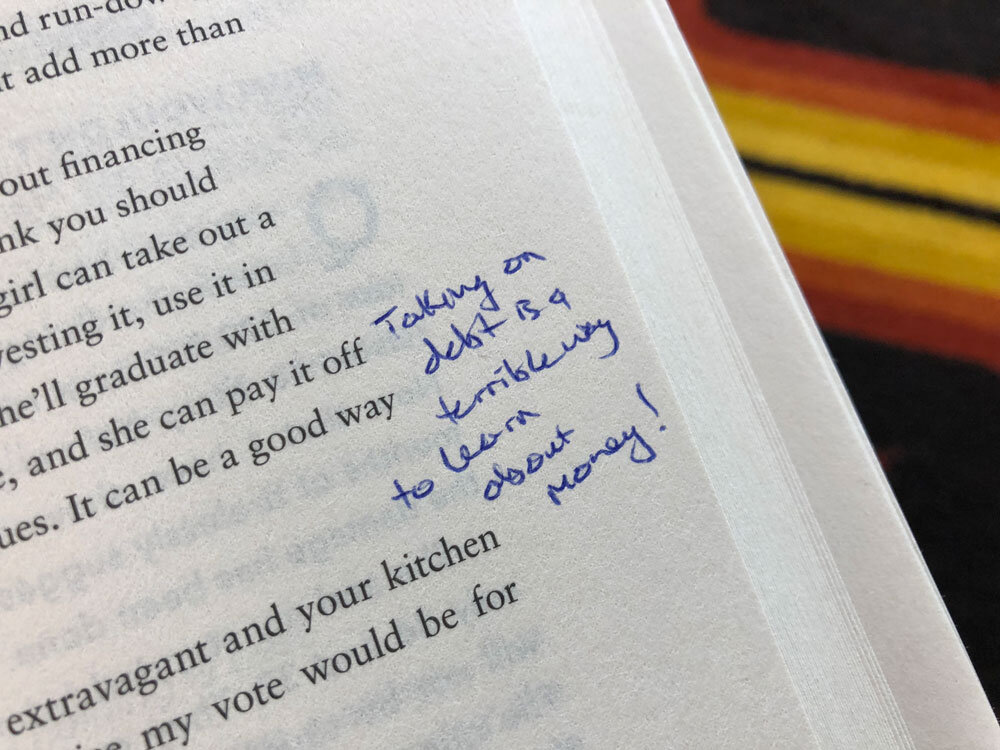

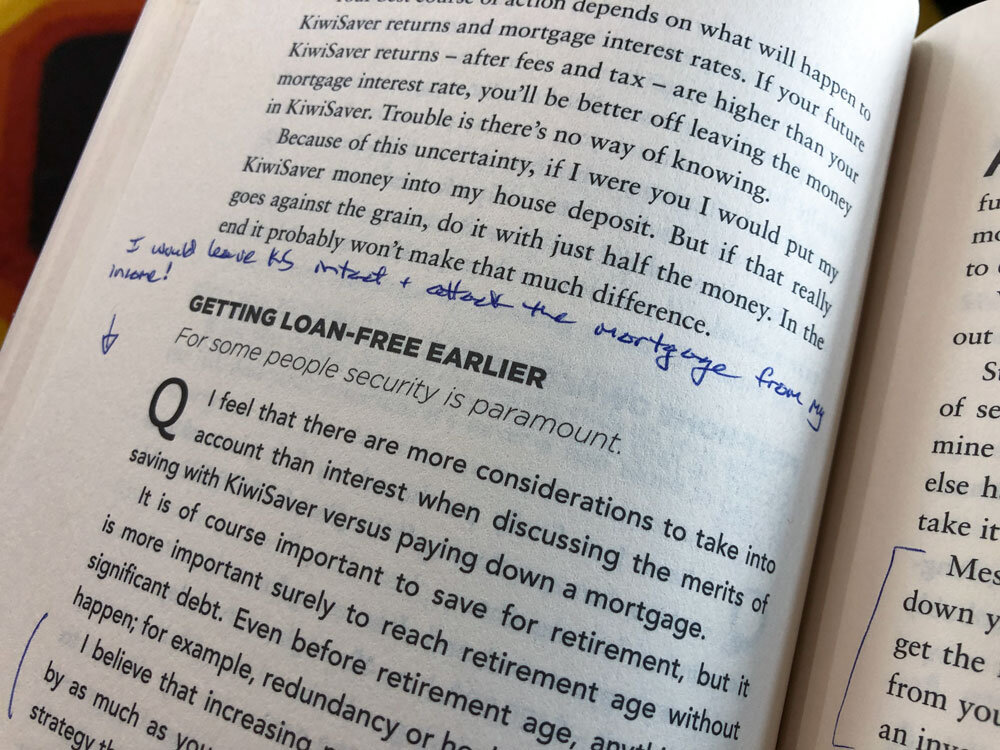

It’s like a conversation but presented in book form and I reckon it would be good to leave it at the hairdressers, smoko room or doctor's office with a pen attached so that people could read a Q & A and then scribble their own thoughts in the margin. That’s pretty much what I did when I read it!

There are few books on personal finance that get to stay on my bookshelf and I think that this is now one of them. I would really encourage you to find a copy and read it yourself.

I contacted the publisher Harper Collins and they have kindly given me three copies to give away. I’ve actually already found a new home for one, I’ve donated it to the Central Otago District Council Library, so this will be able to be read by anyone in the Central Otago and Queenstown Lakes areas.

But the other two are up for grabs and if you would like to enter to win a copy please do. To enter, fill in your details in the form below and I will draw two winners at 12pm on Sunday 13th June.

As always, if you live locally and would like to borrow my own copy (or any of my books), scribbles and all, please just get in touch.

Happy Saving!

Ruth

BOOK GIVEAWAY: A Richer You by Mary Holm

The BOOK GIVEAWAY of A Richer You by Mary Holm was a great success and congratulations to our two winners who each won a copy of the book. Thank you to everyone who entered.