The Rule of 72 and Sharesight - Two Useful Personal Finance Hacks

Feb 16, 2020

Have you heard about the Rule of 72?

It’s a handy one to know and luckily it’s an easy one to use as well. It’s one piece of math I wish I learned in school but sadly didn’t. Or maybe I did, but I just was not listening (highly likely).

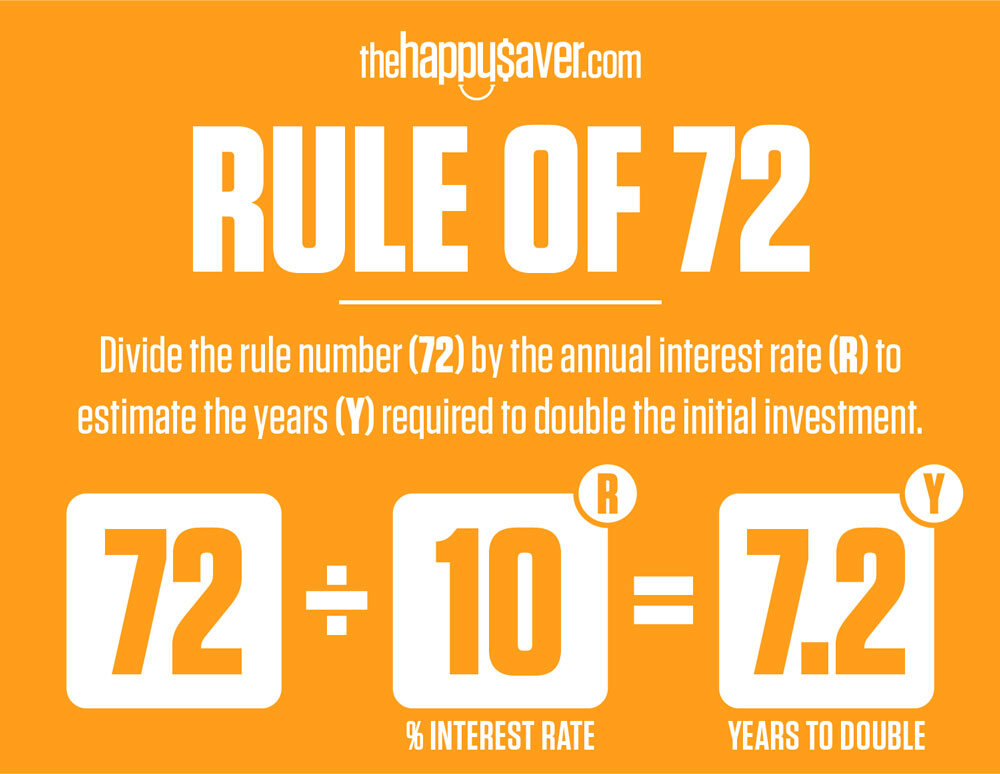

The Rule of 72 is a simple way to determine how long an investment will take to double given a fixed annual rate of interest. By dividing 72 by the annual rate of return, investors obtain a rough estimate of how many years it will take for the initial investment to duplicate itself. Reference: Investopedia

* It gives you a ROUGH estimate which is useful to help you decide if your investments are worth it or not. How handy is that!

The Rule of 72 example: 72 / 10% = 7.2 years

It’s easy to apply the Rule of 72 and calculate how long it could take to double my money if I am using a term deposit where the rate is fixed. Say I lock in $10,000 at 2.65% for 12 months: 72 / 2.6% = 27 years

It would take me about 27 years to double my money (which is why I rarely use a term deposit).

But that begged the question if I am investing in the sharemarket and rates constantly yo-yo up and down, how on earth do I work out my annual returns then and how can I project forward and get an idea of when I’m likely to double my money?

Take the NZ Top 50 (FNZ) for example:

I buy units each month at a different price to the previous month

Twice a year I receive a dividend payout which is reinvested

The share price of the units I own fluctuates throughout the business day

So, how am I ACTUALLY doing, what returns am I actually making and can I predict what the future might bring?

It was trying to work out these sorts of equations that led me to Sharesight a number of years ago. Thank goodness!

I had created my own Numbers/Excel spreadsheet to track my investments but always struggled to work out what my actual returns were, I was only really comparing what my balance was this year compared to last year but that didn’t really give me an idea of actual investment returns because my math was too rubbish to take the varying buy prices into account. And that is when I stumbled upon Sharesight and realised that it could do that for me, I’ve had a number of “ah-ha” moments on my investment journey and this was one of them!

I’ve been using Sharesight, a New Zealand company, for a couple of years now and more recently moved from their free plan, where I can have up to 10 holdings, to their Starter Plan, where I can have up to 20. I finally exceeded 10 holdings because I also wanted to track how my daughter’s investments are going, other than that, the two plans are the same. BUT, I have been playing around with my “portfolio” a lot over the last week and have turned on features like receiving email alerts if there is a company announcement or if there is a price change plus, I now get a weekly portfolio summary sent to me, which should prove a good read! I’ve basically been mucking around breaking things and then working out how to fix them - a great way to teach myself how to use their system more thoroughly than I have before. Plus, I’ve also been using ‘phone a friend’ to help me work stuff out, she is a whizz on this system and I find it’s often easier to talk to someone else who uses it instead of navigating the help features of a website.

One of the many things I like about Sharesight is that it automatically imports dividends and adjustments into my portfolio, so when the FNZ fund gives a dividend, all I have to do is accept it. I still manually add each trade, which is no bother because with this fund I’m only buying it once a month, but I could set it up so that I could automatically bring in these trades (it is called Broker Email Import), but in all honesty, because I’m a fund investor there is not that much trading going on! In fact, there is only buying and I’ve never sold a thing, so doing it manually is fine by me and I actually like to eyeball each transaction, it keeps me in touch.

Sharesight pop-up window which allows me to enter a new trade.

I can see that Sharesight would also be invaluable for the active trader, someone who regularly buys and sells and is trying to gauge the performance of their investments, there are two other paid plans, Investor plan and Expert plan which offer more comprehensive features. I’m not that kind of investor (and nor should you be if I’m honest) but I still find it invaluable for tracking the small number of funds I do have, it just gives me peace of mind that as the years roll by we are on the right track. What I like is the fact that I’ve stumbled upon yet another Kiwi company who have innovated and developed a product that is invaluable to a small self-directed investor who has under ten holdings, for FREE, yet the software is also used by fund managers, accountants and financial advisors who pay for the more comprehensive plans. It’s capable of much much more than I use it for but that’s just fine, it solves the problems that little old me was having and I’m just grateful it’s available.

Plus, using it also helps drown out the noise of the media. Do you know when you see or hear a headline “NZX has massive one day fall” etc? Well, when you can see your investment tracked since the day you started buying it, a ‘massive one day fall’ is viewed as just one day in years of trading and it is barely noticeable on their graph which helps to put things into perspective.

Plus, I have been thinking about tax lately because I’ve received a number of emails asking how to calculate tax in regards to investments and a key feature of Sharesight is also their Taxable Income Report which greatly helps with this. Because I have loaded in my RWT (resident withholding tax) rate it automatically calculates the tax component of a dividend. Plus it lists any imputation credits and these are so important to know about.

Quick diversion: What on earth is an imputation credit? Companies who are in your index fund pay tax. So we don’t need to pay that tax again. So you are issued imputation credits that offset any tax you are due to pay. i.e. if I owed $100 in tax, but I had $30 of imputation credits, my tax bill is now $70.

At tax time I can print off a report to use when I complete my tax return and I know a number of people who do their own tax return and use this feature and they say it’s of huge benefit to them.

When I updated the plan I was on with Sharesight I actually took the opportunity to really analyse what these investments were doing and I made sure that I had loaded in ALL of my transactions correctly, set the correct tax rate and then when I ran some reports it gave me such a clear picture of how our investments are sitting. And I have to say, it was pretty exciting stuff! Only other PF people would get that!

The key thing for me though is I can gauge with accuracy IF our investments are indeed working and I can look at returns since first purchase through to returns in the last day, week, month or year because it is constantly updating. Here are the returns for the FNZ fund since I first started purchasing them back in November 2016 which has taken the dividends I’ve received and the tax I pay into account:

Sharesight graph showing returns for the FNZ fund since I first started purchasing them back in November 2016.

Finally coming back to my point about mentioning the Rule of 72, I can get a rough idea of when I could double my investment for this fund: 72 / 18% = 4 years

Once again, this is a rough idea and I’ve used the average return over the last four years and the period I select will give me a different return percentage, plus who knows what the stock exchange will do in the next four years, but it still gives me a basic idea. If I was running a company, I might want some more certainty around this, but given this is just my personal finances, I’m happy to use this as a guide.

We all discover some tips, tricks and shortcuts in life that are real time savers, or they just help us understand our place in the world a bit better, but it takes someone to tell us about them in the first place. I consider the Rule of 72 and Sharesight as two useful personal finance hacks, which of course I’m happy to share.

Predicting the future is an inexact science and for every investment opportunity you look at it will say something along the lines of “past performance does not predict future returns”, but once you start to build up an accurate historical picture of your own investments you can create some sound numbers and therefore a useful guide to go by. And now that I have three years of investments recorded and being tracked by Sharesight it really helps me gauge my financial position today and where I might be in the future and knowing this just helps me plan ahead, something that we all should try to do.

Happy Saving!

Ruth

You can try Sharesight for FREE to track 10 holdings, but if you have more than 10 holdings, I have a special offer for followers of The Happy Saver. Get 4 months free off an annual premium plan.

* For the boffins out there technically if you use 69.3 instead of 72 you will achieve higher accuracy, but for the rest of us 72 works just fine and is easier to remember.