Tracking Your Net Worth

Mar 12, 2017

If you would prefer to listen to me read this blog post, please click on the play button.

I will be quick this week!

It is important to track your net worth. How else can you know where you are financially so that you can plan for the future? The most important thing is to understand your financial position today so you can be moving in the right direction. And in our case it stops us being tempted to buy shiny expensive things like new cars too.

I don’t wear a Fitbit but I would wear a Net Worth tracker on my wrist. Now, there is an idea! Could someone else invent that please, I’m never going to get around to it.

Put simply your net worth is:

What you own vs what you owe which leaves how much you actually have.

I thought about sharing what my net worth is but there really is no point. My numbers suit the financial goals of my family and might look quite different to your numbers. I might look like a pauper compared to you or I might look rich. It is irrelevant.

We started out with nothing at all, then we took on a mortgage and we owed more than what we owned. But slowly and surely as we paid of debt and began to build equity our net worth began to build. I found regular monthly monitoring a good way to see incremental changes in the right direction. Once we paid the house off it then began to slowly but steadily increase. And so it goes on today.

Becoming financially independent is not just about your salary. I’m sure we all know people with huge salaries with low net worth because they consistently spend more than they earn. Houses, boats, cars etc can give the overall appearance of wealth but if you own none of it I’ve got a bit of a surprise for you. You are not doing ok. If all that is keeping you afloat is the monthly paycheque then where does that leave you if it stops? When you put the actual numbers down on paper it tells it how it is. It looks at EVERYTHING you have: your home if you have one, retirement savings, investments, cars and of course debt. You can then compare year on year and work out if you are going backwards or forwards.

I just have a bog standard spreadsheet on my computer. I fill in my numbers at the end of each month. To find the value of the house I look at others that have recently sold near me and estimate a figure from that. I go lower because I don’t want to over inflate the price of my house because CLEARLY my house is better than everyone else's right?! Same with cars.

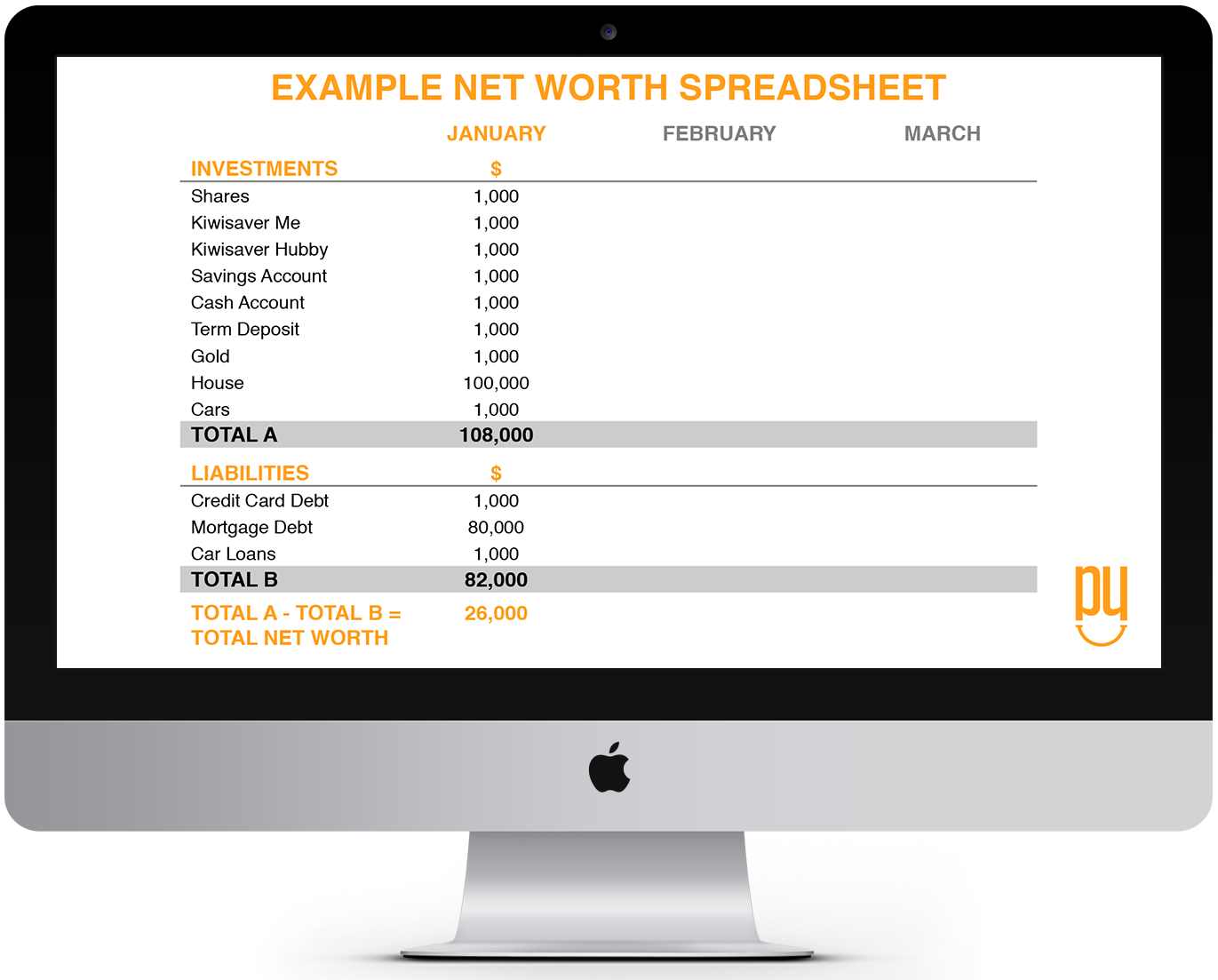

An example of what a simple Net Worth spreadsheet would look like.

I don’t include the contents of my house because I don’t really have any intention of selling them. I know what they are worth because I have insurance on them but I don’t see them as being relevant to my net worth. You might think differently, if so write it down. You might invest in other things, so write them down too.

Since paying off our mortgage our net worth has come from about 10 years of steady monthly saving into the various areas that you see above. I tend to add everything up to a total figure and then add the house on. The reason is the house value will do what it does but as I put new money into investments each month I want to see that they are actually growing and working. Investment accounts are black and white, the value of my house is guess work (until it is sold).

Once I have totalled up how much I have, then I deduct what I owe (currently $0) to get my final figure.

Tracking our net worth dictates whether we can afford to take a holiday this year. It needs to be growing year on year and if taking a holiday will make us go backwards then we won’t. My sister referred to this as a sacrifice the other day. I think of it as being realistic and sticking to my philosophy of spending less than what we earn.

Networth is a moving number. Some months it goes up a lot, some months just a little. It is the best tool I have found to track how we are ticking along. I created my spreadsheet and was tracking before I even knew there was a name for what I was building - a net worth tracker. It gives me a sense of security that we are financially ok. As long as the overall trend is upwards I’m a happy camper.

How much is enough? I simply don’t know. Money is a very personal thing and my goal is to keep it growing over time and to invest it where I can protect it. I know we could go out tomorrow and buy new cars or book a cruise and pay with cash but tracking our net worth really keeps me honest. I don’t want to see it take that sort of hit so we resist the temptation to spend. And as you know these temptations are everywhere. Currently we know lots of people booking cruises and it is REALLY HARD to not jump on board so to speak! I keep reminding myself I get terribly seasick and watch YouTube clips of cruise liners getting hammered by waves at sea to suppress the temptation...

So, if you, like me are serious about getting on top of your finances then start tracking, otherwise you are just guessing where you are at. You can Google “net worth trackers” and be faced with heaps of options but to be honest if you want one tailor made to your situation then just create your own. A pen and paper is equally useful too!

Happy Saving AND Tracking!

Ruth