Let's Buy Gold!

Jun 12, 2016

“As good as gold.”

— Charles Dickens

Many years ago I worked in the gold mining industry. I appeared to have thrown my environmental concerns directly out of the window and was lured by the cash. There was lots of cash on offer. I drove huge dump trucks loaded with gold up and down bumpy haul roads. I did this for a few years both in New Zealand and Australia. Then each university holiday I went back. Sure beats picking fruit on minimum wage I figured.

Me and my 150 tonne dump truck in Australia.

Unfortunately I took no interest whatsoever in the price of gold at the time; hindsight is a wonderful thing. I was more interested in immediate returns such as my large pay packet each week and all the free food and board I was receiving in the mining camp. I must have moved thousands of loads of dirt but in all that time I never ever saw even one speck of the shiny stuff. Never. Ever. I recall trying! Sometimes there was a lot of waiting around when the digger blew yet another O Ring. A good way to pass the time when we were left waiting at the bottom of the pit was by looking for just a speck twinkling in the sun, or even better a nugget. But nothing. Ever.

But the shiny stuff still interested me. Many years later when I got married we purchased plain gold bands for less than $200 apiece. I finally had some of the shiny stuff. I recall my Dad saying once that he did not understand the point of gold. He said we spent all that time getting it out of the ground to melt it down, sell it and put it back in the ground again by way of banks and vaults. He had a point you know and I have always remembered it.

Last month I was out running in the hills. I was 5km down a rocky track to nowhere and happened upon a guy lurking in the rocks. I don’t know who got the bigger fright; me, him or my dog. My dog is very large, so it was probably him. Turns out he was searching for gold and produced a metal detector to prove it.

“Any luck” I asked?

“Well, ah, you know, um, have not given up my day job just yet” he responded. Cagey.

But after a chat I surmised that his gold prospecting hobby offered him enough return to encourage him to keep trekking into the hills. His return was both the gold he found and the satisfaction of finding it. Or trying to.

More recently I was out walking my dog and came across an older guy working away on the side of the road in the industrial area of my town. I was in the process of giving him a wide berth when he called out to me. Turns out I knew him but just didn’t recognise him under all his grubby overalls, weird hat and dark glasses. Now once in awhile you meet someone who you find intensely interesting to talk to and for me this guy is it. In his 70’s now, he used to be involved in mining. As our conversations are usually had in passing on the street or in a busy cafe we pretty quickly got talking about what interests us both. Today it was gold. He has been out of the game a few years now but still has a bit in the safe. He told me he gets it out from time to time just so he can ‘have a look at it’. “It is just so nice to look at” he said and he always likes to make sure he has some around. Interesting.

I have been increasingly thinking about buying some of the real stuff because as you can see, it keeps coming up in conversation. My interest is not the gold that has already been worked into beautiful jewellery, with the additional costs of buying it, but buying it in its raw form. I want to buy it for its weight, not for its collectibility such as collectible coins or jewellery. I am interested in purchasing something that has an exact value that I can look up the price of and determine the value of my investment. And it would also be something pretty to look at. A ingot would be nice. Or two. Or more.

However, I realised I had absolutely no idea how you buy it or indeed what I should, could or would buy. What does an ingot of gold even mean?

FACTS I HAVE LEARNED ABOUT GOLD which were useful in answering the questions I had:

The standard unit of measurement for pricing gold is per troy ounce which is 31.1034768 grams.

Coins that weigh one troy ounce are the most commonly traded.

I have found a website called www.goldprice.org and I check in with this every few days to see what the gold price is. I’ve been doing this for a while now so have begun to get a feel for its ups and downs. The gold price is very easy to understand and if the numbers don’t mean much to you then the useful graphs will. I also use www.morrisandwatson.com

The gold price is live and fluctuates throughout the day.

Why buy something that does not produce an income? If I am buying it my intention is that it will rise in value, but this will most likely take some time. Would I be better to put my money into a different investment? Possibly, but I already have a few of those on the go so I’ve thought about it and am happy to sit on gold.

Gold and other precious metals are priced in US dollars so buying in NZ dollars is a juggling act as we also have to take into account the moving exchange rate and what the US dollar is up to. The websites above show the price in NZ dollars. If you hear the price mentioned at $1,200 don’t get too excited that it has had a massive drop as this will be US dollars!

Where do I store it? I’ve thought about this too. I’m typing on a computer right now that is worth $2,000 new. It is not bolted to my desk. My phone is worth $1,000 and that is carelessly thrown in my handbag wherever I go. I have a display cabinet with meaningful trinkets in it, why don’t I just put it there? I might take a friend’s advice on this one though. Its nice to have it and to hold it, but I might just tuck it away out of view and under lock and key.

The trader you buy it off will also offer secure storage at a cost. I don’t anticipate having a huge quantity that would need this sort of pay as you go storage.

I need to buy my gold off a bullion trader and they are going to charge me for the service. If I bought gold today and sold it tomorrow I would receive less, purely because of the difference between the buy and sell prices. As with anything you buy, different products and suppliers have different margins and are dependent on supply and demand.

At this time in New Zealand Pure Gold attracts no Goods and Services Tax (GST) of 15%. From the Inland Revenue (IRD) website I learned that gold with a fineness of not less than 99.5% are not subject to GST.

When buying through a broker it will cost you more to use your credit card to buy.

If you buy granules as an investment they arrive in a sealed packet. Do Not Unseal The Packet if you are intending to sell it again.

Gold is transportable. I could put an ounce in my pocket and sell it anywhere in the world. It is a universal currency.

My engagement and wedding rings are not an investment. The price of a ring you buy is always far higher than the materials that have gone into it. Buy jewellery because you love it instead.

Several people also made it very clear that you have to ‘sight your gold’ and they each refer to the case of the ‘missing gold’. Back in the 1980’s Goldcorp sold gold to lots of people just like me. To show what we had purchased we were given a certificate. The gold sat safely in their bank. But it didn’t. They sold the SAME gold time and time again. When people came knocking to collect or sell their gold or even to just have it to gaze at it from time to time they discovered there was no gold. Lesson learned. Always sight your gold.

There are apparently 45 mints around the world producing gold coins. You can google all of this yourself and learn about the pros and cons but my search narrowed down to the following options:

1. Krugerrands

These coins are from South Africa and have a Springbok Antelope on one side and the Former south African President Sephanus Johannes Paul Kruger on the other. Purity of 91.67% (22 karat)

They were the first gold coins to contain exactly 1 troy ounce (31.1 grams) of fine gold. They come in 1, 1/2, 1/4, 1/10 ounce. The gold is mined in South Africa.

They were not designed to be pretty but as a "lump of gold" people could buy and own. I considered it because it is a solid gold coin with guaranteed gold content. Because it is not pure it attracts GST and you also pay a coinage fee with any coin.

2. American Eagle Gold Coins

Apparently “the most popular coin in the world”. The gold is mined in the USA. Coins are struck with 91.67% 22 Karat gold. The gold is weight stamped on each coin plus special dyes give it a radiant glow. They come in 1, 1/2, 1/4, 1/10 ounce. They contain a small amount of alloy or copper and silver as well as the stated amount of gold to improve the hardness and resist scratching. The weight, gold content and purity are all guaranteed by the US government.

3. The Canadian Maple Leaf

First minted by Royal Canadian Mint in 1979. Is pure .9999 (24 Karat) with no additional alloys added. The purest gold coins. Has Queen Elizabeth II on one side and the maple leaf on the other. They are made of gold mined in Canada. They come in 1, 1/2, 1/4, 1/10 and 1/20 ounce. The cost of these is little more than the value of the gold. They are valued by investors, collectors and jewellers.

4. NZ Gold coins

What about Kiwi gold? Is that worth the investment? It is .9999% pure, 24 Karat and comes in 1, 1/2, 1/4 ounce. It has a Kiwi on one side and a Map of New Zealand on the other with the words Aotearoa. It is not as easily recognised worldwide but is readily bought and sold in NZ and Australia. They don’t have individual serial numbers but are stamped with the suppliers hallmark. I like the idea of buying local and am thinking that if I only ever intend to buy and sell here in this country then it could be a good option. However it does not fit with my theory of buying a lump of gold because it has been worked into a coin and you pay a small premium for this.

ENOUGH TALK, LET'S BUY SOME!

I rang a friend of mine who is a jeweller (he is fabulous and you can find him here (www.facebook.com/decortdesign) and had a good chat with him about how he buys the gold he needs for his jewellery. He deals with Morris and Watson here in NZ and has done for years. He has an account and texts them his requirements. He pays online and they send it out to him pretty smartly. The small quantities he requires arrive by secure courier. Text for gold?! I know! Modern times indeed.

Now, I had already Googled “how do you buy gold in NZ?” and came up with a lot of suppliers but you know what, sometimes a recommendation from a trusted source is enough for me, so I didn’t shop around, I just phoned these guys. When I asked where their gold came from the following was explained to me. Most of the gold that makes up the ingots is from the NZ mining sector, mostly Central Otago and the West Coast. They buy from mines who have alluvial operations (gold is extracted with water and not chemicals). Also in each ingot will be some scrap gold and gold that is also refined from the left overs from manufacturing jewellers (they literally refine down the sweepings of dust off the floor). So, it is a bit of a mixture with the NZ gold content probably being around 90%. Traceability is important to them and he likened it to buying fair trade coffee, they only buy from known origins and mining practices.

A look at their website and a search under buying gold gives you a shopping list to choose from. Exciting stuff! You can buy Fine Gold ingots varying in size from 1 oz to 1kg. They also sell Krugerrands, Kiwi coins and Sovereign coins.

I am writing this in May and I’ve been watching the gold price which is tracking up at the moment.

Gold is constantly going up and down but over the last 30 years has tracked up and that is what I’m more interested in. I’m thinking long term here.

So, I’m going to take the plunge as gold prices move up and down by the hour. The only return I will get is if the price has gone up when I choose to sell. No dividends, no interest, just relying on an upwards movement of price. I’m unlikely to get rich from this purchase as it is far too small but it is going to do better than sitting in Bonus Bonds or in the bank on a poxy low interest rate.

I used to buy Lotto tickets many years ago but the feeling of being personally robbed each week when results didn’t go in my favour wore a bit thin. I didn’t give up entirely and instead bought $20 of Bonus Bonds weekly. At least this way I may win a prize (I have not!) and I will at least get all my money back. I will use this money for my gold. I’ll keep buying my Bonus Bonds (more on these another day) and when enough builds up I intend to pull it out and buy more gold.

I’m going to spend approximately $2,000. I sent an email to Michael from Morris and Watson (garland@clear.net.nz) on Thursday. The price on their website at that moment was NZ $1936 oz. I simply asked to buy “1oz Fine Gold Morris and Watson Cast ingot, please.” I pointed out that I’m new to this and could he please advise me of exactly how to go about it.

Half an hour later Michael phoned me. He was friendly, helpful and informative. He was so helpful that I almost felt bad for taking up so much of his time with all my questions and then my very small purchase. I narrowed down my choice to the above because after listening, reading, researching I worked out that I just want to buy a chunk of pure gold. At .9999% fineness it attracts no GST. If I were to buy a coin this would attract a premium. If I were to buy Krugerrand then these are not pure and would also attract GST.

He also discussed selling my gold. My purchase price today is $1,935 plus costs. If I was to turn around and sell to him today I would receive $1787. They make their money on the difference between the buying and selling costs. I liked his upfront honesty about this.

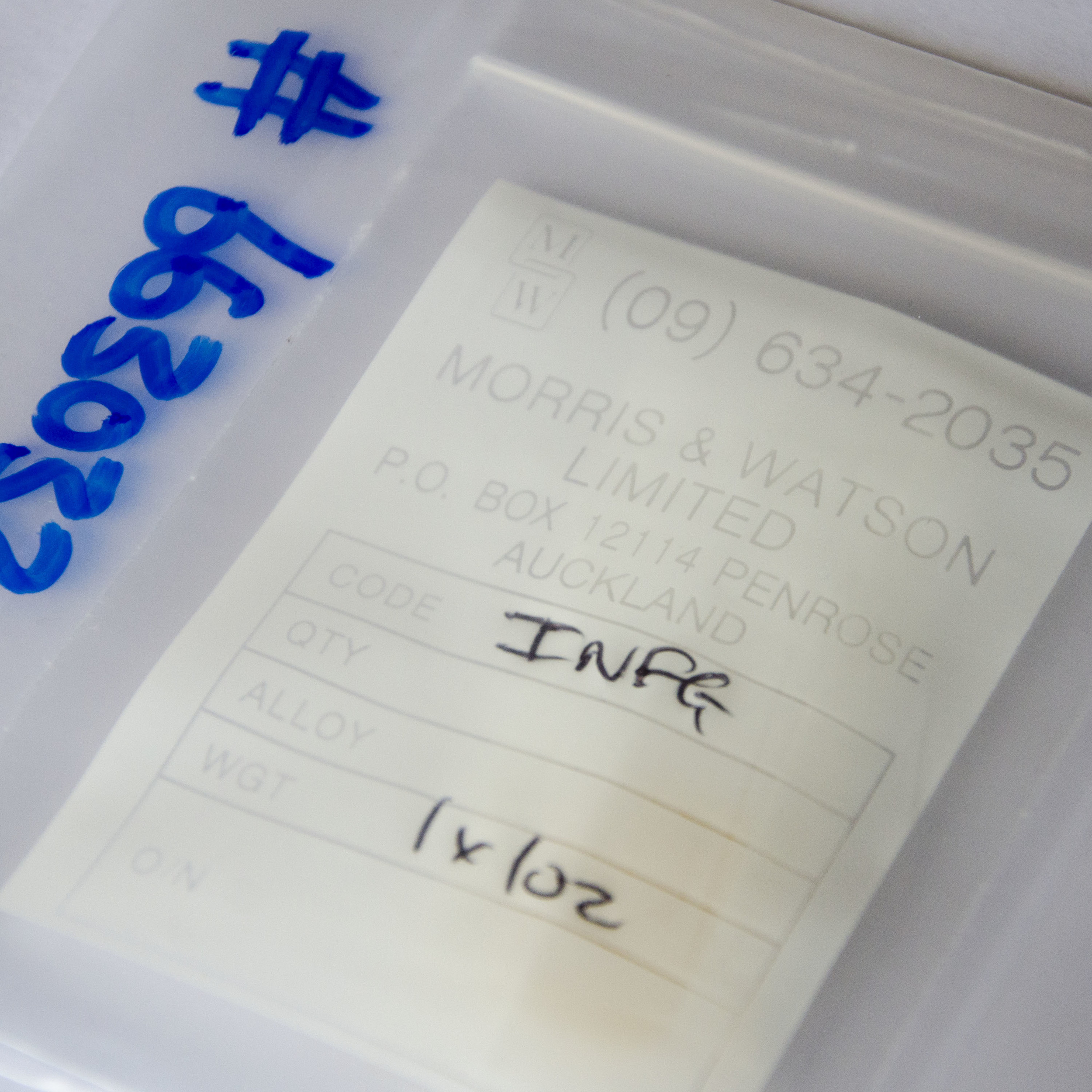

Michael informed me that since my email the price had dropped $1 to $1935 per oz so that is the price I would be buying at (had it have gone up then I would have had to pay the new price). Further costs included an Ingot Fee of $8. He explained that typically they pour ingots to order using fine gold granules.

The courier fee was $6 and they they provide insurance on the courier. I will need to sign for the package when it arrives.

The total GST to pay was... $2.10!

So, my total purchase amount is now $1951.10 for 1 oz.

They emailed me an invoice which I immediately paid online. As soon as they saw the money in their account they sent the gold.

On Saturday morning I wandered out to check the mailbox and low and behold there was a package. So much for signing for the courier… Ordered on Thursday afternoon, it arrived on Saturday morning. Not bad!

It was a standard courier package with no return address (just a phone number), inside of which was a padded bag. Inside that was another bag, inside which was another bag, inside which was MY GOLD!

I knew it would be small, but it was VERY small, but at least it is small and HEAVY.

A bag, within a bag, within a bag.

It's getting exciting now....!

1oz Morris and Watson Cast Fine Gold ingot (31.10 grams).

Ingot dimensions (mm): 15(W) x 25(H) x 5(D)

The gold ingot resting in my daughters 8 year old hand. Trying to make it look bigger!

It was a bit of an exciting occasion for the family and we all had a hold of it. And like me, others are a little intrigued by it too. My gold has been brought out at the dinner table on a few nights with friends to oohs and ahhs and exclamations of “is that it, it’s tiny, but HEAVY!”. A gold ingot is not something you see every day and prior to doing this I had no concept of what an ounce of gold actually meant. But now it is tucked away, just like my Dad said it would be. Dug out of the ground, just to be hidden away again. Oh and the price dropped after I bought it but so be it, I’m playing the long game remember… Despite that I do think that of all of the investments I’ve tried this is the most fun one so far! And the prettiest.

Happy Saving!

Ruth

“Gold is forever. It is beautiful, useful, and never wears out. Small wonder that gold has been prized over all else, in all ages, as a store of value that will survive the travails of life and the ravages of time.”

— James Blakeley