What about the bit in the middle: Medium Term Investing

Aug 5, 2018

Some time back I asked you for questions that you needed help finding an answer to and as a result heaps of questions headed my way. I’m slowly working my way through them. Thankyou!

This week I picked out the following two questions, both quite similar, to have a crack at answering:

What options are there for mid-term investments? Term deposits are great in the short term and shares and property (should) be good in the long term, but what about that bit in the middle? We're expecting to shift to the big smoke in the next six to eight years, so have a keen interest in that middle ground. Thanks Ruth! Dan

I'm a 20 year old student with about 23k saved in the bank, and I want to start making my money work for me. What are the best ways to invest my money to make good returns over 5-10 years? I've looked into investing in managed funds and bonds, but there are so many different options it's kind of overwhelming. I'd like more financial advice from someone with more experience than me. Cheers! S

Whenever I answer emails to people one on one I always like to remind you that I’m not an AFA and these are just my opinions...

Let’s assume you have all your debts paid off - and by debts I mean a mortgage, a student loan, credit cards, car loans, a loan from your dear old Mum. The reason is because my personal point of view has always been that “you can’t make money while you owe money” regardless of what interest rates on debts/investments are. And I know that the mathematicians amongst you may disagree but my reason is a simple one; life is just so much LESS COMPLICATED when you don’t juggle debt and investing.

And can we pause at this point and give a high five to S for being a 20 year old student with $23,000 in the bank! Whatever you are doing mate, just keep doing it!

So all that being said the two email writers are working hard and money is coming into their bank account. The very first thing I would do is set up an automatic transfer to syphon off a set amount of money each week into a sub account with your bank and give it a flash name like “IKMSMOI” (investments keep my sticky mitts off it). This will start to build quicker than you realise at which point you begin to understand just how rubbish bank interest rates really are. Here is an example:

A balance of $17,421.54 which earned $19.28 in interest after tax for the month. 1.55%. A bit pathetic yeah?

So here is what I would consider doing:

Pay off debt first.

Build a pot of money with my bank that is liquid, i.e. that I can access straight away in case I hit a bump in the road (I don’t borrow money so for me this needs to be $15,000 - $20,000 to be able to comfortably snooze at night). Once I start investing elsewhere I don’t want to be needing to use ANY of that invested money in the short term so I need savings close at hand to cover emergencies.

Pay the minimum into my KiwiSaver to get my employer contribution and the member tax credit from Jacinda Ardern. Always.

Start stockpiling money and develop a savings habit week in and week out. Use this time to work out if I am likely to steal money from myself to buy crap I don’t need or dip into it on a big night out with the girls/boys. When this amount builds to $5,000 without me drawing any of it out I am probably starting to develop a good savings muscle.

Start thinking about what I might need it for and start putting time frames around these things: Tertiary education (5 years?), house deposit (5 years?), overseas trip (1 year?), buying my first car (1 year?), replacing my first car (1 year?), saving for retirement (25 years plus).

The general rule of thumb is the higher the risk of an investment, the higher the return and if my timeframe for needing the money is short (1-10 years) I don’t want to be taking a lot of risk because there is a chance that the markets have a downturn and when I go to access that money the value has dropped to less than what I invested, which is obviously what we are trying to avoid.

If the ‘thing’ I was saving for was less than 5 years away, sorry to tell you Dan, but to be honest I would just use term deposits because they have a known rate of return and each time I saved up say $5,000 I would find the best rate going and sign up for one year. If my current bank was offering a lower rate than a competitor I would pick up the phone and ask them to match it and if they say no, then just open up your term deposit with the bank with the more favourable rate. I have zero loyalty to any bank and would not hesitate to have different TD’s in different banks. Then I would save up another $5,000 and lock it in for another year. Save up another $5,000 and lock it in for another year... You get the drift. Get them paid back out to you when they mature and then once again secure the best term deposit rate you can find before locking it in again. And always keep your end goal and date that you are saving for in mind and be careful not to lock your money away beyond the date you will need to access it (when I worked in the building industry homeowners were often locking money up that they needed to pay for the house build - and then stressing themselves out because the bank would not let them break the term deposit OR took away any interest owed, so be careful).

Interest.co.nz Deposit Calculator

You can choose a Term Deposit or a PIE Fund - the difference is that PIE investments have a max tax rate of 28% so if your tax rate is 33% typically these will save you a little more.

I warn you that it’s going to be a lonely road though, especially when your $5,000 matures and they pay out your return LESS tax. Term Deposits are not your path to riches I am afraid but they are a safer harbour to protect your money while you save for an event.

You can find out rates here: Pocketwise - Compare Term Deposits

Or here: Interest.co.nz - Term Deposits 1 to 5 Years

They also have a handy calculator for you to compare different rates: Interest.co.nz - Deposit Calculator

I remember when we used to get much higher term deposit rates but that’s not today’s market I’m afraid. But this is still a sound option for short term investing. It is to save for a goal with a date attached to it. Personally I would not be using this as a long term strategy because the returns are just too poor and my money is better off elsewhere.

If I were saving for a ‘thing’ that was beyond say 6 years I would consider investing in a managed fund outside of KiwiSaver that was not chasing big returns but was instead aiming to protect and grow my nest egg, that way if the markets have a downturn I have time to let it recover before I need it. I need to be cautious but not too cautious.

Every bank offers a private portfolio service of some type where they will invest your money for you at an appropriate risk level BUT sometimes they have limits as to how much you need in order to make a start, such as $5,000, $10,000 or even $100,000 and these are often long term active investment strategies. Don’t be put off as it’s still might be worth approaching your bank in the first instance just to see what they can offer you.

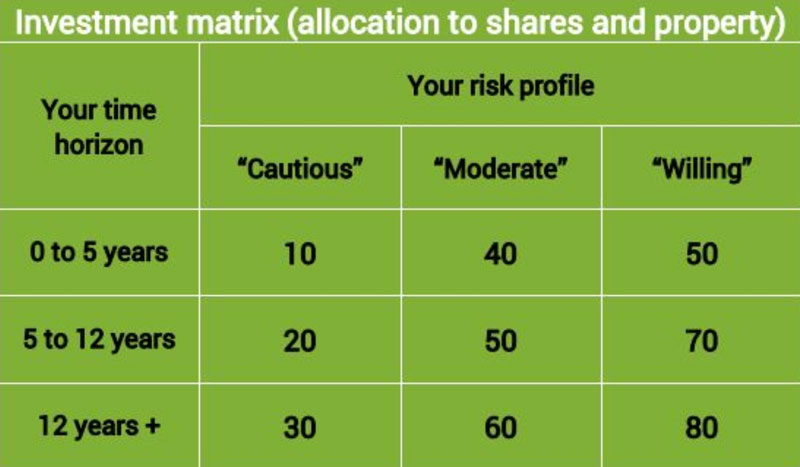

While researching this blog post I was made aware of this Investment Matrix from SuperLife which I thought was kinda handy:

Balancing risks and return - the investment matrix

In deciding your investment strategy, you need to balance your timeframe and your required returns (income and inflation protection or growth) with your risk profile. This should let you work out how much of your savings should be invested in shares and property and how much in cash and bonds.

Your “best” mix of assets will combine your time horizon with your risk profile.

Investment Matrix - Source: MCA NZ Limited

The number in the matrix represents the “theoretical” exposure to shares and property for different combinations of time horizons and risk profiles. For example “60” means 60% shares and property, and therefore 40% in bonds and cash.

In broad terms, the matrix tries to balance your timeframe, your likely income needs, the risk of inflation and your risk profile. You should also consider the current market outlook before making a decision.”

Taken from: SuperLife Investment Guide

Now I know that the problem I often face is being spoiled for choice (“first world” problem I know!) and so often I read a great blog but it never actually gives me enough DETAIL to start my own research and make an investment decision, so I’m going out on a limb here…

There are many providers and many funds (ANZ, TSB, this bank, that bank, InvestNow, Simplicity...) but I thought I would take a quick look at SuperLife and pretend I was wanting to invest for 5-12 years with my risk profile being “willing” (is it just me or is this an odd word to use?). A poke around their website tells me that SuperLife 80 would be a sound option for ME as with its mix of investments it is considered 4 out of 7 on their “risk indicator”. In the last year it has had a return, after tax (28%) and after charges, of 7.84%. This could be a fund that I invest in on a monthly basis until I have reached the amount I am saving for at which point I could just cash it out. Follow this link for a break down of the fund: SuperLife 80

Why THIS managed fund? Well, they juggle things around to keep within certain parameters. They have a mix of cash, fixed interest, equities (shares) and property and they have targets in their portfolio for what percentage they hold of each. And they do the juggling, not me. I just invest on a regular basis and leave it up to them - that is why they are called ‘managed funds’ 😉

SuperLife 80 current allocation between asset classes.

Now, I can hear you groaning at my less than interesting saving strategy, well, sorry to tell you but saving and creating wealth is a pretty chilled out process - particularly if you are aiming for lower risk because you really need to protect that nest egg you are building up for that THING you are saving for. But you will agree that it is looking more attractive than Term Deposits right? If you are looking to turn $10K into $100,000 in JUST SIX MONTHS then I can’t help you I’m afraid because in my experience slow and steady wins the race. I have bought snazzy bitcoin and I can tell you that at the moment it is definitely NOT winning the race! Haha.

And the questions I was asked above are for people who are saving for “something” which is different than saving for the sake of saving. They need to know that their money is there when they need it and they can’t afford to take on high levels of risk. If they are saving $100,000 for a house deposit they need to be comfortable that their own money they are investing, plus the returns they earn on their investment will get them to their required figure.

In my time investing I’ve enjoyed a pretty good ride, not much has gone wrong (except when we were idiots and bought into a tech start up) but history tells me that won’t always remain the case and that with my higher appetite for risk there WILL come a day when my portfolio takes a hit. And it will take time, potentially years, to recover. So don’t get too cocky with your short term investing would be my advice, be cautious but just ambitious enough to make sure you can reach your goal quickly, yet safely.

Happy Saving

Ruth

I wrote this whole blog and then I found this: A Guide to Investing

*Despite me mentioning names and links, this blog post contains no affiliate links!