Offset Mortgages. Really?

Mar 18, 2018

Because I threw off the shackles of debt some time ago I have become a little out of touch with mortgages. Just that very sentence does make me sound like a complete w****r, but don’t judge me too quickly. Please! This blog post may ruffle a few feathers, but stay with me as I do refer to ducks near the end...

I’ve had enough emails about “Offset Mortgages” to make me think that this is something I need to look into because there are obviously a few of you out there who either use this system of banking or want to know what it is all about. I don’t know what it is about either but with a bit of Googling and some help from a few of you I have been forming an opinion…

When we had a mortgage it just started out with 80% of it on fixed interest, with fixed payments and 20% of it terrifyingly on a floating interest rate where we could make varying payments. This was our first ever mortgage and in case there is any doubt about my opinion on debt, this was to be our only mortgage. We were so worried about interest rate rises that could appear almost overnight and destroy us that putting any part on a floating rate was scary. Remember our parents talking about paying 20% interest on their mortgage in the 80’s?. What if? Ouch!

But our fears were unfounded and as it turned out we pretty quickly decided that debt was not for us and we needed to get the bankers off our back, not that they were not quite nice, they did offer to lend us more money... So when the opportunity came to review our mortgage we moved the whole lot to a revolving credit mortgage which is basically like a giant overdraft and the interest rate we paid varied. Now we were feeling confident and it was the banks turn to be extremely worried for us and they cautioned us about the risk we were taking on.

Revolving credit basically meant we had one big pot of DIRTY OLD DEBT in one account. All the money we earned went into this account, all the money we spent came out of this account. IF, and only IF we were disciplined enough to spend less than we earned week after week would the balance inch its way painfully slowly back to zero. Well, much to their surprise we WERE disciplined enough and the day we hit $0 and began to climb into positive numbers it was a cause for celebration. I know of a woman who took out exactly the same level of debt at the same time as us, using a revolving credit mortgage and today her mortgage has ballooned to around $400,000. So, SHE was the customer the banks feared (loved) would not have the savings discipline to handle this type of arrangement.

But it appears to me that nothing stays the same in anything, including banking and there are many ways and many products that you can utilise to pay back debt. The marketing departments of every bank have been extremely busy.

Let’s look specifically at an offset mortgage because it is the one type that I hear the most talk about. I looked at a couple of the banks for this and a very helpful subscriber Lizi also shared with me her experience with Kiwibank.

So, what exactly is an Offset Mortgage?

An offset account is one or more savings or everyday accounts linked to your home loan account. You have debt in one account and “savings” in another.

Typically debt incurs interest and savings earn interest. But not here, the linked (saving) accounts earn no interest. In an offset account they simply put the balance of your transaction/savings accounts against the debt you owe. All the while keeping them seperate.

E.g.

$200,000 mortgage

$10,000 in an offset account

You only pay interest on $190,000

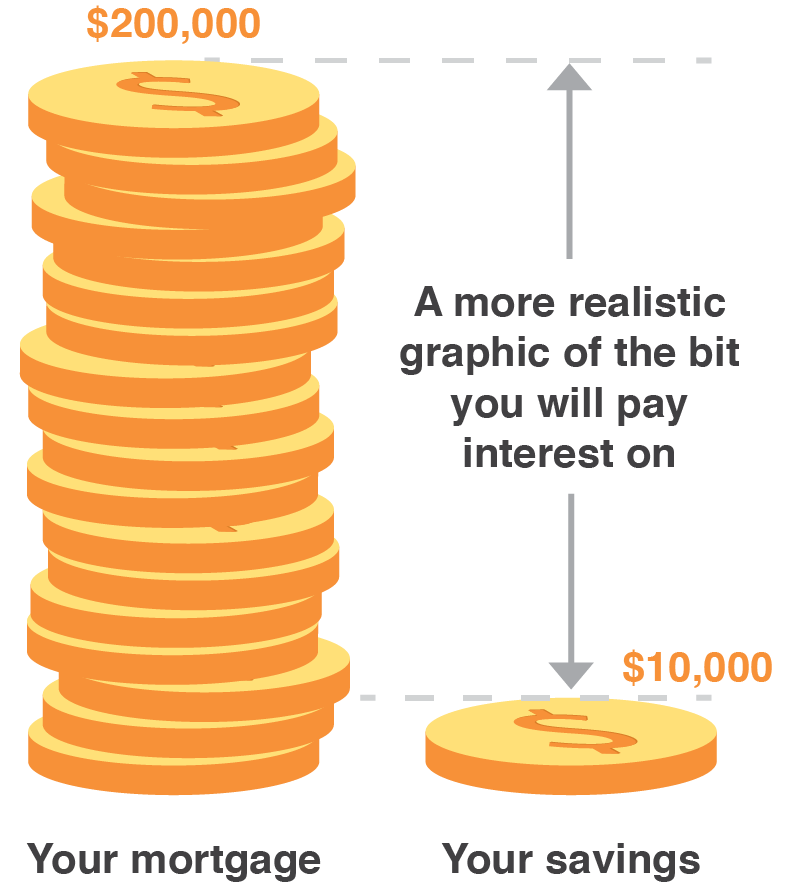

The bank's graphic of what bit you pay interest on. Make's the bit you pay interest on look smaller than it actually is.

I think this is more of a realistic graphic of the bit you will pay interest on.

Pretty simple strategy I guess.

Now, another thing I found out is that you can link up to eight accounts to your mortgage and you can bring in the whanau to help you… including “your partner, parents and children”. How well would that conversation have gone with my parents I wondered? A resounding “NO” would have been the answer and it also got me thinking about how financially exposed parents would become if they tagged their savings accounts to your debt? If you could not make the payments, what then? Who is the bank going to turn to next? And of course by putting THEIR savings towards YOUR debt they lose any interest they would have earned too. If you have this set up in mind, then you had better start to be real nice to your folks...

I see they also charge a $250 sign up fee at Kiwibank which always amazes me too. If over a 25 year mortgage they are making $14,880 a year in interest off the $400,000 they lent you (or $372,000 in interest over the life of the loan) you would think they could waive the fee perhaps? Please make sure you ask the question of your banker...

Unlike the revolving credit mortgage I had where I could withdraw money again if I wanted to, with this offset mortgage, once you actually put money into that mortgage account, you can’t get it back out again, which some see as a negative but I see as a positive because you have just paid off some debt - permanently! Hoorah! The very point of paying debt off is that you don’t want to draw it back out again.

Lizi explained that she liked this offset mortgage setup because it helped her to budget and I can see her point. She had one account where she can clearly see her mortgage balance and then several other accounts that served different purposes for her. For example, one may be tagged “emergency”, one for “day to day expenses”, one for fixed “monthly bills”.

Then the marketing department has gone even further and offered even more choice to the customer...

Just like you can have many transactional accounts, with your mortgage you can break that up into different chunks too. You can have a portion which is on a variable interest rate which your offset accounts are linked to, a portion fixed for say a two year period and a portion fixed over three years. With the thought being that you can attack the offset mortgage component because it allows you to make any payment that you like (great for people on variable incomes), while you are paying a fixed amount on the other two. By the time you pay the offset portion down to zero, then it is time to refinance and you can bring a new portion onto an offset mortgage.

OH MY! Talk about mathematical debt gymnastics. Talk about putting a simple concept through “The Complicator” (a giant machine that my family designed to make the most SIMPLE concept COMPLICATED!)

Let’s try an example of how this could work:

BANK: “You owe us $100,000”

YOU: “Sure, at 6% interest I will pay you back $844 every month for 15 years. Paying you a total of $141,894”.

Now let’s put this through The Complicator:

Let’s use a real life example of someone who emailed me this week (thanks so much for letting me use your numbers A).

BANK: “You owe us $191,600”

YOU: “Sure, I’m going to set up an offset mortgage…

Mortgage #1

$19,700 with fortnightly payment of $117 at an interest rate of 5.65% variable rate. With 12 years and 10 months remaining. This one has various offset "savings accounts" against it with a total of $10,000 in them.

Mortgage # 2

$81,000 with fortnightly payment of $323 at an interest rate of 4.65% fixed. Up for renewal on the 5.2.2020 but with 12 years and 11 months remaining.

Mortgage #3

$90,900 with a fortnightly payment of $264 at an interest rate of 4.8% fixed. Up for renewal on the 14.3.19 but with 21 years and 3 months remaining.

Thanks for those numbers A, now back to my own thought processes where I have MADE UP the rest of the example:

After two years, all going to plan I should have been able to pay off Mortgage One of $19,700 (this is with fingers crossed nothing unforeseen has cropped up, like braces for my child or a new heat pump or roof needed for the house). Then I’m going to refinance and create another portion that is on a variable rate that is offset to my eight accounts (food, emergency, rates, insurances, holiday, car, home maintenance, clothes). Then I will simply rejig mortgages two and three to reflect the new amount owing and the new interest rates of the day.

Meanwhile, I will be saving into my everyday accounts because it really helps me to budget AND that money is being put against my debt saving me interest AND I don’t pay tax on my "savings"! Bingo!

It’s all so simple really and I really feel COMPLETELY in control of my debt!

I tried to explain this arrangement to my husband and he thought I had gone INSANE.

At this point I want to relay a conversation I had with an ANZ representative last week while researching this blog post. I asked her about offset mortgages and she said that her bank does not offer them “because they are really just a fancy way of having a revolving credit mortgage”.

Yep.

I’m wondering why you would bother with all of the above. It is kind of a false reality. It is kind of like when you are lining up in a massive queue at Disneyland that zigzags its way to the front. You appear to be really close to the ride, but in actual fact you have miles and go! Your savings account (or accounts) are not really savings at all, because you have more debt than savings. I can see it could give a sense of security because you would look at your ‘savings’ accounts and feel comfort at having $20K there or whatever, but if on the other side you have $200,000 in debt then umm sorry to have to tell you this. You actually don’t have any savings at all. You have $180,000 of debt.

These sorts of banking debt gymnastics are exactly why I don’t like debt. What a gigantic convoluted hassle. It’s straight up marketing to make you “feel” in control of your debt by giving you the comfort of having “savings”. But if it looks like a duck, sounds like duck. It’s a duck. You still have debt. You don’t have any savings.

I explained my thinking to the ANZ woman and she said “Yep”.

I understand that having other accounts could help you budget and to many they give you peace of mind knowing that some money is tagged for other uses, but you can also achieve the same thing... with an actual written budget. So, why not just get a simple mortgage with one big pot of debt, or maybe split it into a portion fixed and a portion floating and then follow a written budget? Now that we are debt free I still have a budget where I plan for every event, but instead of planning my debt repayments I now plan my savings/investing payments. So, instead of putting the responsibility of knowing where your money is at with a bank, you take that responsibility over yourself because at the end of the day no one will look after your money as carefully as you will.

So, in conclusion, I now understand how offset mortgages work and I’m calling on my psychology degree when I say that it seems to me that it is all smoke and mirrors designed to make you feel in control of your finances. Giving you the feeling of being “a saver” to lessen the blow of having a large mortgage for the next 30 years of your life. In the words of a woman who wrote to me this week “It’s got to be better than this”.

Yep, it sure does, but you have to take control and improve the situation yourself, otherwise the marketing department of your local bank will be more than happy to help you out. I would love to hear your thoughts in the comments below.