So, this week I thought I would share some of the really positive snippets and lessons that I’ve taken from the emails I’ve received from many of you in the month of May because you say SUCH GOOD STUFF.

All in Personal Finance

Kernel Index Funds Review

Under the “Our Story” section on the Kernel website, they say the following: We encourage open and free sharing of opinions so that everyone feels as though they can collaborate and contribute.” Not the usual spiel you would find on a fund manager website, don’t you agree?

Why save, plot and plan for my financial future?

There has been quite an increase in questions over the last couple of weeks, which is not at all surprising given how much uncertainty is out there. And this week, having answered so many emails, plus I was finishing writing and recording my final podcast episode of this series, I’ve not quite gotten around to a new blog post. So this week I’ve decided to republish a post I wrote back in 2017 because I feel that it’s still very relevant today.

Your Questions: Wage Subsidy, KiwiSaver, Debt

I asked you last week what I could help you with and I received a lot of emails with questions on various topics. I have pulled a couple of themes out of them and have shared them in this post, because my guess is that they are pretty common questions right now.

The COVID-19 Emergency Budget Meeting

If there was ever any doubt about what an emergency might look like, well this is it, folks! I hope that each and every one of you is coping well and today I wanted to let you know what Jonny and I are doing, in the hope that you might gain a few pointers about what to do with whatever situation you may find yourselves in.

PocketSmith Q+A

In February 2020 I went to Dunedin to spend the day with the PocketSmith team. I asked my audience if there were any specific questions they had about using the PocketSmith budgeting software and I put those questions directly to the support team in the office. PocketSmith has answered all of your questions and I’m the first to admit that I’ve learned a thing or two by reading them.

The share market is doing what it does, so JUST CHILL!

I’ve had a “conscious uncoupling” from worldwide events and am instead reflecting back on the basics of how Jonny and I operate to make sure we are steering our waka in roughly the right direction during these rough waters. This is the first more serious market dip I’ve been through but I’ve read enough and learned enough from those who have gone before to know that the right thing to do is just hold my course and hold my nerve.

Applying The Barefoot Investor in NZ - UPDATE

I originally wrote this blog post back in December 2018 and I’ve decided it was time to make a few updates to it so that all those people reading the book for the first time and those who are following along with the Barefoot Investor principles have a good New Zealand resource to come to. If you have read my original post, while it’s still relevant, this one is quite different because it takes into account different providers of services, so I encourage you to read this one too!

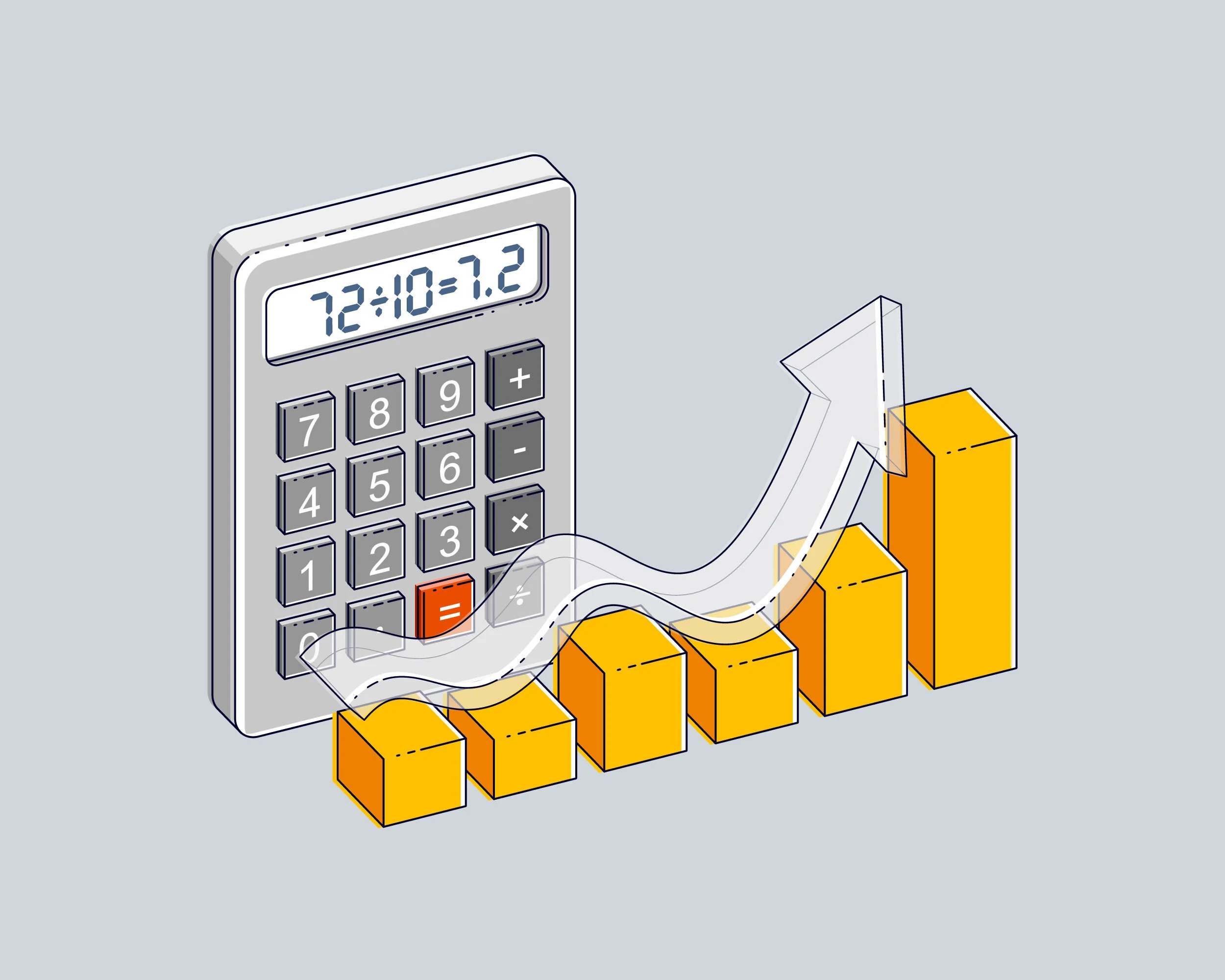

The Rule of 72 and Sharesight - Two Useful Personal Finance Hacks

We all discover some tips, tricks and shortcuts in life that are real time savers, or they just help us understand our place in the world a bit better, but it takes someone to tell us about them in the first place. I consider the Rule of 72 and Sharesight as two useful personal finance hacks, which of course I’m happy to share.